Uncover Lucrative Opportunities: Your Manual for Selecting a Reputable Hard Money Lender in Atlanta

Wiki Article

Adaptable Financing: Recognizing the Function of Hard Money Lenders

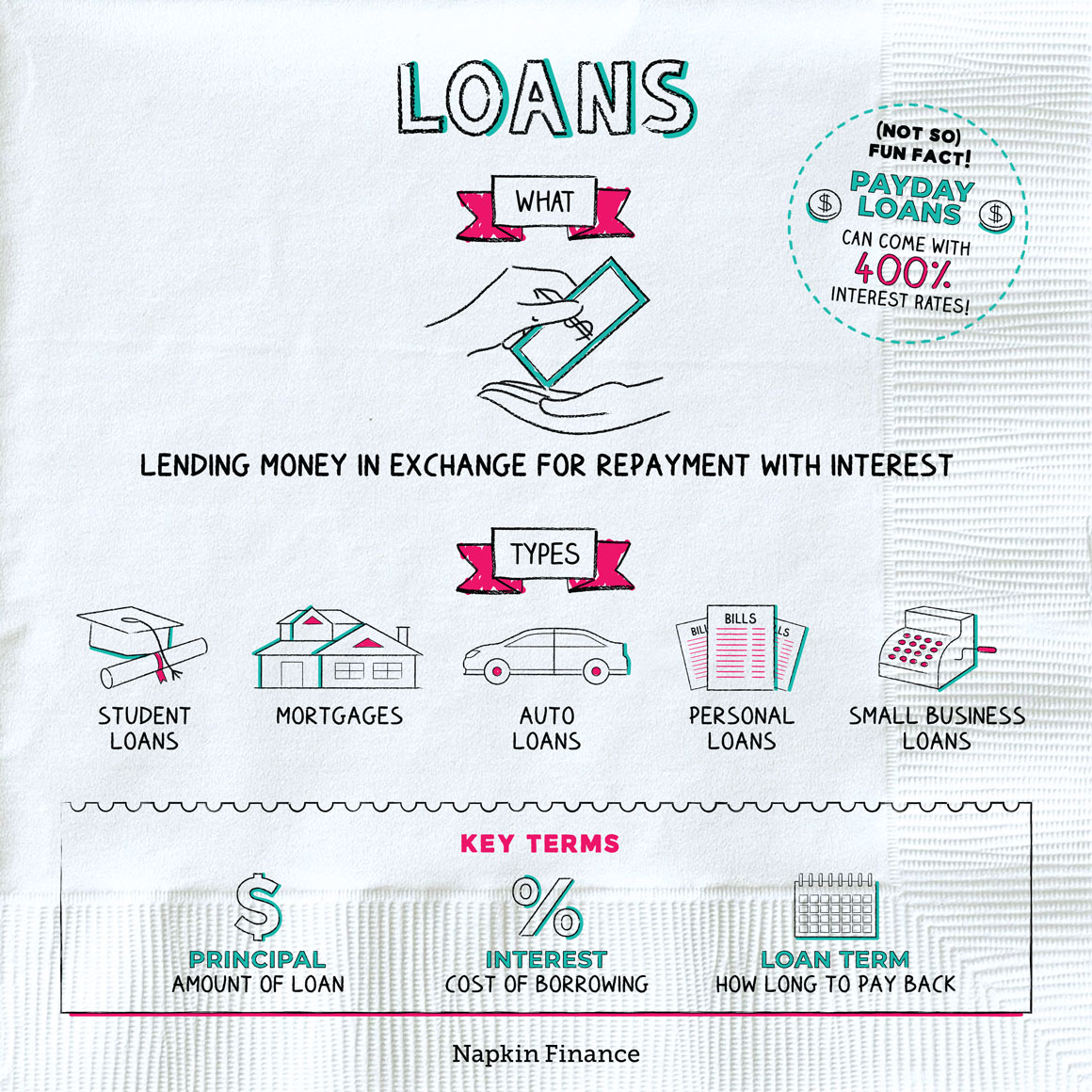

Flexible financing is a crucial facet of any type of company or realty venture. Comprehending the role of tough money lenders is important for those seeking choice financing options. Difficult cash loan providers are exclusive people or companies that use temporary fundings safeguarded by genuine estate security. Unlike conventional banks, hard cash loan providers concentrate on the worth of the residential property instead of the customer's creditworthiness. This allows borrowers with less-than-perfect credit rating or special conditions to access the financing they require. In this guide, we will check out the advantages of hard money lending, the credentials procedure, and the value of security. In addition, we will provide tips for selecting the ideal hard cash lending institution to suit your certain financing requirements.What Are Difficult Money Lenders

Tough money lenders provide a variety of lending choices, consisting of fix-and-flip car loans, building financings, and swing loan. These finances are commonly utilized by genuine estate financiers or programmers that require fast accessibility to funds for residential or commercial property acquisition, renovation, or various other investment functions.

Nevertheless, it is essential to note that hard money car loans typically include higher rates of interest and costs contrasted to standard financial institution finances. This is because of the higher risk related to these kinds of financings and the much shorter payment periods generally offered by tough cash loan providers.

Benefits of Hard Cash Lenders

The benefits of functioning with hard cash lenders are many and can significantly profit borrowers in demand of flexible funding alternatives. Unlike conventional financial institutions, hard cash lending institutions focus largely on the value of the building being used as security, instead than the borrower's credit reliability.Another benefit is the flexibility in funding terms. Difficult cash loan providers are commonly extra eager to customize and discuss finance terms to fulfill the details demands of the debtor.

Furthermore, difficult money lenders supply access to funding choices that may not be offered via traditional loaning organizations. This is particularly true for borrowers with inadequate credit history or restricted financial background. Difficult money lenders are more concentrated on the value of the collateral, making it less complicated for debtors with less-than-ideal credit score to protect a funding.

How to Receive a Difficult Money Loan

Getting a difficult cash finance includes showing the capability to repay the financing with the assessment of certain criteria. Unlike typical financial institution car loans, which often need extensive documents and a high credit rating, difficult cash loan providers concentrate mainly on the worth of the residential property being used as security.To receive a difficult cash lending, debtors generally require to provide details about the building, such as its location, condition, and approximated worth. Lenders will likewise take into consideration the borrower's experience in property investing and their departure approach for paying back the finance.

Creditworthiness is less of a figuring out variable for tough money lendings, as lending institutions are primarily interested in the residential property's worth and the borrower's ability to make timely rate of interest repayments. This makes difficult cash financings a sensible choice for borrowers with less-than-perfect debt or those that may not get approved for conventional small business loan as a result of rigorous borrowing criteria.

It is necessary to note that hard cash loans frequently come with higher rate of interest and much shorter settlement terms contrasted to standard small business loan. They use versatility and a official website quicker approval procedure, making them suitable for genuine estate investors looking for rapid funding choices.

The Role of Security in Hard Money Lending

To safeguard a difficult money loan, consumers need to offer security that lines up with the lender's needs. Collateral is a vital component of tough money borrowing, as it acts as a guarantee for the lending institution in situation the borrower stops working to repay the financing. Unlike standard lenders that primarily concentrate on the borrower's credit reliability, hard cash lenders put a substantial emphasis on the security offered.Security can take various types, such as property properties, automobiles, or various other important properties that hold substantial market price. The lender evaluates the value of the security and identifies the car loan quantity based on a percentage of its evaluated value, recognized as the loan-to-value ratio (LTV) The LTV proportion can vary depending upon the lending institution and the specific scenarios of the car loan.

In case of default, the lending institution has the right to market the security and seize to recover the impressive loan amount. This is why difficult cash lending institutions often require collateral that is quickly marketable and has a steady worth. In addition, lending institutions might likewise call for individual warranties or added security to more safeguard the loan.

It's essential for debtors to comprehend the value of security in difficult money financing. By supplying appropriate and useful collateral, customers enhance their chances of securing a tough cash finance and getting to the versatile financing alternatives these lending institutions use.

Selecting the Right Hard Money Lender

When picking a tough cash lending institution, it is essential to thoroughly assess their track record and record in the sector. Selecting the appropriate hard cash lending institution can significantly affect the success of your funding requires. To guarantee you make an educated decision, consider the following elements.

To start with, credibility is key. Search for a loan provider with a solid credibility in the industry. Inspect on the look at this site internet reviews and testimonials from previous borrowers to determine their degree of client fulfillment. A reputable lending institution will certainly have a specialist and transparent approach to borrowing, supplying clear terms and conditions, and delivering on their assurances.

Secondly, take a look at the loan provider's track record. For how long have they stayed in business? Do they have a history of successfully funding projects similar to your own? A lender with a tried and tested track record in your particular market or particular niche will better comprehend your funding needs and offer customized remedies.

Hard cash loan providers vary in their loaning criteria and terms. Look for a loan provider who is ready to work with you to customize a financing remedy that fulfills your special demands.

Lastly, assess the lender's level of customer support. A dependable lender will have a receptive and experienced team that can address your inquiries and worries without delay. Great communication is essential for a smooth and effective lending procedure.

Final Thought

In verdict, hard money lending institutions play an essential function in giving flexible financing choices for companies and people. It is important to very carefully pick the best difficult cash lending institution to guarantee a successful loaning More hints experience.Typical bank financings can take weeks or also months to process, whereas tough money loan providers can commonly money a lending within days. Tough cash lending institutions are more focused on the value of the collateral, making it easier for customers with less-than-ideal credit scores to protect a finance.

To safeguard a difficult cash financing, borrowers must give security that straightens with the lending institution's demands. Security is a necessary element of difficult money lending, as it serves as a warranty for the lending institution in instance the debtor stops working to pay back the car loan. Unlike conventional lenders that mostly focus on the borrower's credit reliability, tough money loan providers place a substantial focus on the collateral provided.

Report this wiki page